I’ve recently started a project with some friends to read and discuss the Incerto Series by Nassim Nicholas Taleb:

- Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets

- The Black Swan: The Impact of the Highly Improbable

- The Bed of Procrustes: Philosophical and Practical Aphorisms

- Antifragile: Things That Gain from Disorder

- Skin in the Game: Hidden Asymmetries in Daily Life

As I read and think about them, I will write some of the points here to reflect more on them and make them part of my mindset.

I want to read them chronologically, so the remaining of this post and next couple of posts on this subject, will be from the first book listed above – fooled by randomness.

Preface – Written by Nassim Nicholas Taleb for the 2nd Edition

1. Hindsight Bias

Past events will always look less random than they were (it is called the hindsight bias).

Nassim Nicholas Taleb

Daniel Kahneman in Thinking, Fast and Slow says:

Your inability to reconstruct past beliefs will inevitably cause you to underestimate the extent to which you were surprised by past events.

Daniel Kahneman

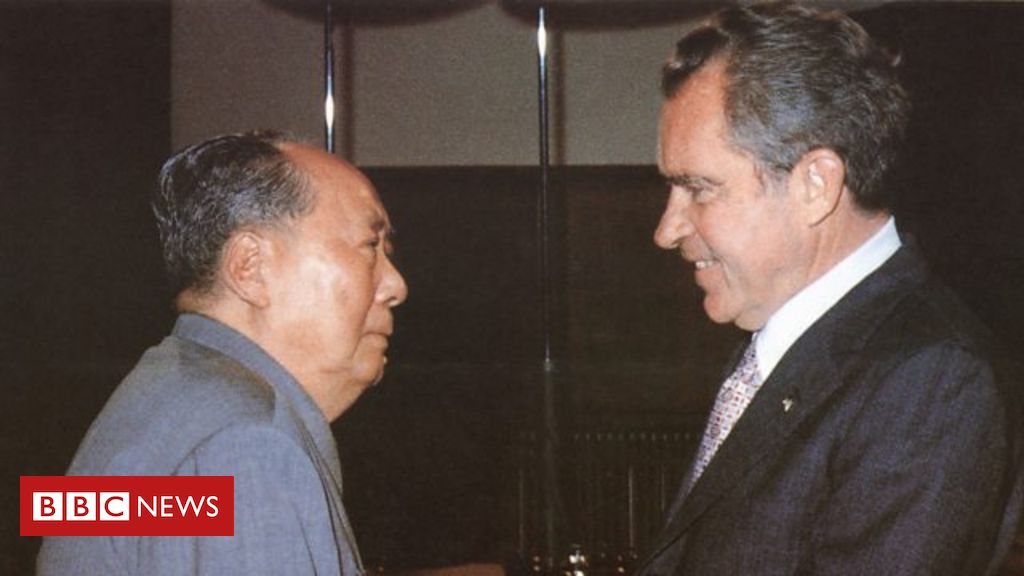

Baruch Fischhoff and Ruth Beyth first demonstrated this “I-knew-it-all-along” effect or hindsight bias by surveying before Nixon visiting China and Russia in 1972.

Fifteen possible outcomes were listed and the respondents were asked to assign probabilities to them, e.g., would Mao Zedong agree to meet with Nixon?

After the visit, they asked the same people to recall the probability that they had originally assigned to the outcomes. You already know the results:

If an event had actually occurred, people exaggerated the probability that they had assigned to it earlier.

If the possible event had not come to pass, the participants erroneously recalled that they had always considered it unlikely.

Daniel Kahneman

2. The Core of Probabilistic Thinking

Outside of textbooks and casinos, probability almost never presents itself as a mathematical problem or a brain teaser.

Nassim Nicholas Taleb

Mother nature does not deliver problems in a textbook way (in the real world one has to guess the problem more than the solution).

In this book, considering that alternative outcomes could have taken place, that the world could have been different, is the core of the probabilistic thinking.

This line – in the real world one has to guess the problem more than the solution – is a reminder of a sentence that I heard and encountered many times: Patients do not read textbooks.

The combination of symptoms and degree of typicality varies from patient to patient. Here, first, the problem should be made clear.

3. It Is More Random Than We Think

Just as our brain does not easily make out probabilistic shades (it goes for the oversimplifying “all-or-none”), it was hard to explain that the idea here was that “it is more random than we think” rather than “it is all random.

Nassim Nicholas Taleb

4. Chance Favors the Prepared

Let me make it clear here: Of course chance favors the prepared!

Hard work, showing up on time, wearing a clean (preferably white) shirt, using deodorant, and some such conventional things contribute to success – they are certainly necessary but may be insufficient as they do not cause success.

The same applies to the conventional values of persistence, doggedness and perseverance: necessary, very necessary.

One needs to go out and buy a lottery ticket in order to win. Does it mean that the work involved in the trip to the store caused the winning?

Of course skills count, but they do count less in highly random environments than they do in dentistry.

Nassim Nicholas Taleb

5. Affirming the Consequent Fallacy

Notice how our brain sometimes gets thee arrow of causality backward.

Assume that good qualities cause success; based on that assumption, even though it seems intuitively correct to think so, the fact that every intelligent, hardworking, persevering person becomes successful does not imply that every successful person is necessarily an intelligent, hardworking, persevering person (it is remarkable how such a primitive logical fallacy –affirming the consequent– can be made by otherwise very intelligent people).

Nassim Nicholas Taleb

Prologue

6. Lucky Fools

This book is about luck disguised and perceived as nonluck (that is, skills) and, more generally, randomness disguised and perceived as non-randomness (that is, determinism).

It manifests itself in the shape of the lucky fool, defined as a person who benefited from a disproportionate share of luck but attributes his success to some others, generally very precise, reason.

Nassim Nicholas Taleb

7. Belief Formation

The formation of our beliefs is fraught with superstitions – even today (I might say, especially today).

Just as one day some primitive tribesman scratched his nose, saw rain falling, and developed an elaborate method of scratching his nose to bring on the much-needed rain, we link economic prosperity to some rate cut by the Federal Reserve Board, or the success of a company with the appointments of the new president ” at the helm.”

Nassim Nicholas Taleb

8. Symbolism

Symbolism is the child of our inability and unwillingness to accept randomness; we give meaning to all manner of shapes; we detect human figures in inkblots.

“I saw mosques in the clouds” announced Arthur Rimbaud, the nineteenth-century French symbolic poet…

He gave up poetry in disgust at the age of nineteen, and died anonymously in a Marseilles hospital ward while still in his thirties.

But it was too late.

European intellectual life developed what seems to be an irreversible taste for symbolism – we are still paying its price, with psychoanalysis and other fads.

Nassim Nicholas Taleb

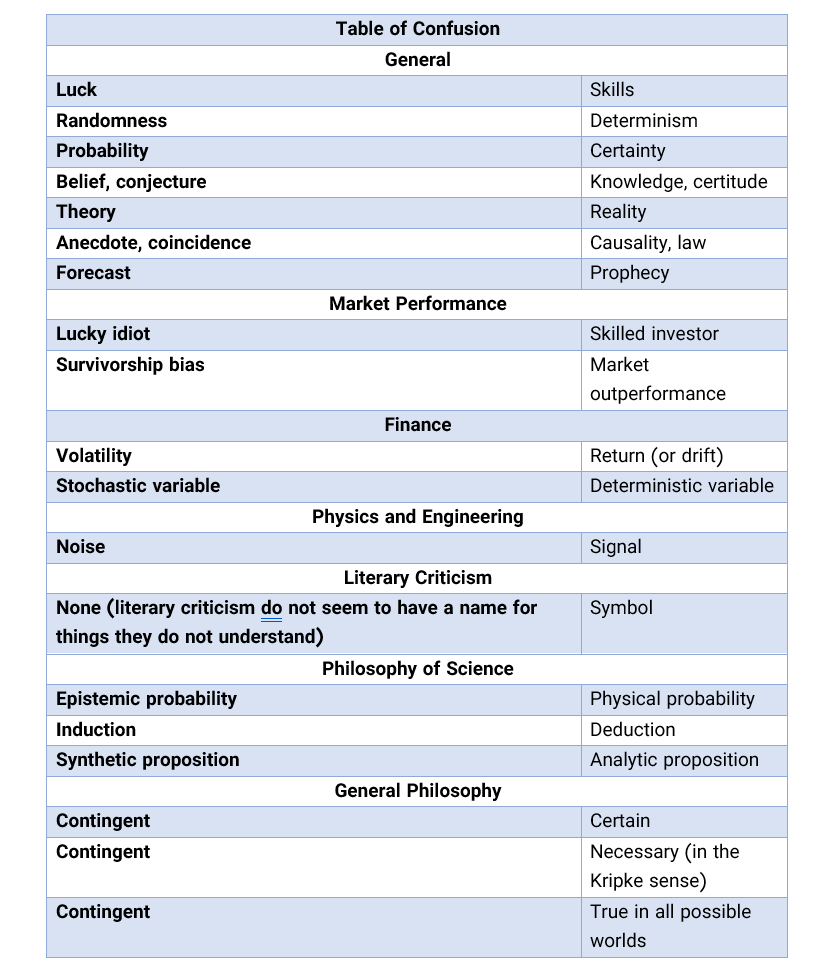

9. Table of Confusion

10. Acceptance

We are faulty and there is no need to bother trying to correct our flaws.

We are so defective and so mismatched to our environment that we can just work around these flaws.

I am convinced of that after spending almost all my adult and professional years in a fierce fight between my brain (not Fooled by Randomness) and my emotions (completely Fooled by Randomness) in which the only success I’ve had is in going around my emotions rather than rationalizing them.

Nassim Nicholas Taleb

If You’re So Rich, Why Aren’t You So Smart?

11. Judging the Success of People

Can we judge the success of people by their raw performance and their personal wealth? Sometimes – but not always.

A large section of businessmen with outstanding track records will be no better than randomly thrown darts…

They will fail to make an allowance for the role of luck in their performance…

Lucky fools do not bear the slightest suspicion that they may be lucky fools – by definition, they do not know that they belong to such a category. They will act as if they deserved the money.

Nassim Nicholas Taleb

12. Virtuous Cycle and Vicious Cycle

It has been shown that monkeys injected with serotonin will rise in the pecking order, which in turn causes an increase of the serotonin level in their blood – until the virtuous cycle breaks and starts a vicious one (during the vicious cycle failure will cause one to slide in the pecking order, causing a behavior that will bring about further drops in the pecking order).

Likewise, an increase in personal performance (regardless of whether it is caused deterministically or by the agency of Lady Fortuna) induces a rise in serotonin in the subject, itself causing an increase of what is commonly called “leadership” ability. One is “on a roll”.

Some imperceptible changes in deportment, like an ability to express oneself with serenity and confidence, make the subject look credible – as if he truly deserved the shekels.

Randomness will be ruled out as a possible factor in the performance, until it rears its head once again and delivers the kick that will induce the downward spiral.

Nassim Nicholas Taleb

A Bizarre Accounting Method

13. Alternative Histories

I start with the platitude that one can not judge a performance in any given field (war, politics, medicine, investments) by the results, but by the costs of the alternative (i.e., if history played out in a different way).

Such substitute courses of events are called alternative histories.

Clearly, the quality of a decision cannot be solely judged based on its outcome, but such a point seems to be voiced only by people who fail (those who succeed attribute their success to the quality of their decision).

Nassim Nicholas Taleb

14. Russian Roulette and Reality

Reality is far more vicious than Russian roulette.

First, it delivers the fatal bullet rather infrequently, like a revolver that would have hundreds, even thousands, of chambers instead of six.

After a few dozen tries, one forgets about the existence of a bullet, under a numbing false sense of security.

The point is dubbed in this book the black swan problem, as it is linked to the problem of induction, a problem that has kept a few thinkers awake at night.

It is also related to a problem called denigration of history, as gamblers, investors, and decision-makers feel that the sorts of things that happen to others would not necessarily happen to them…

There is an ingratitude factor in warning people about something abstract (by definition anything that did not happen is abstract).

Nassim Nicholas Taleb

15. Probabilistic Skepticism

Realism can be punishing. Probabilistic skepticism is worse.

It is difficult to go about life wearing probabilistic glasses, as one starts seeing fools of randomness all around, in a variety of situations.

Nassim Nicholas Taleb

16. Fools in Risk Assessment

Try the following experiment.

Go to the airport and ask travelers en route to some remote destination how much they would pay for an insurance policy paying, say, a million tugrits (the currency of Mongolia) if they died during the trip (for any reason).

Then ask another collection of travelers how much they would pay for insurance that pays the same in the event of death from a terrorist act (and only a terrorist act).

Guess which one would command a higher price? Odds are that people would rather pay for the second policy (although the former includes death from terrorism).

It is a fact that our brains tends to go for superficial clues when it comes to risk and probability, these clues being largely determined by what emotions they elicit or the ease with which they come to mind.In addition to such problems with the perception of risk, it is also a scientific fact, and a shocking one, that both risk detection and risk avoidance are not mediated in the “thinking” part of the brain but largely in the emotional one (the “risk as feelings” theory).

The consequences are not trivial: It means that rational thinking has little, very little, to do with risk avoidance. Much of what rational thinking seems to do is rationalize one’s actions by fitting some logic to them.

Nassim Nicholas Taleb

17. Common Sense

I remind myself of Einstein’s remark that common sense is nothing but a collection of misconceptions acquired by age eighteen.

Nassim Nicholas Taleb

2 comments On Nassim Nicholas Taleb (1) – Fooled by Randomness

Randomness versus uncertainty! This is what I was thinking while reading the post. I believe distinguishing between these two can also help us to prevent being fooled by randomness. Randomness is something more and above. Some(Most) parts of uncertainty can be well predicted with high confidence and avoided, in that case, we have more info and the probability of being surprised and consequently fooled is less. On the other hand, those completely random occurrences without any notice or prediction are much more shocking. So, when they happen completely random (without any knowledge even about their probability distribution or their nature) it is more possible to think in “all-or-non” manner.

The last thing, yet more important, is to take into account the value of the incident’s cost/benefit times the probability of its occurrence. This is the crucial thinking approach we need when we opt to risk/decide. Otherwise, we may be fooled by the high probability but the very small cost/benefit or vice versa. The worst case is to ignore any precautions by not well considering the cost of an incident, e.g., the death of people, because of its low probability. This concept may be mentioned in the book but I wanted to highlight it here since I clearly remember that understanding this concept of probability was a turning point for me.

P.S.: I may finally start reading this book 🙂

Hello ? How are you?